How “Higher for Longer” Interest Rates Can Impact Your Investments

The stock market has had a rough ride this past month. The S&P 500 index closed out April at 5035.69, down over 200 points (-4.2%) since the close of March. Investors have become pessimistic and frustrated, and it’s largely because the deep interest-rate cuts that the market expected early in the year just aren’t materializing.

The “good news” coming out of the Fed’s May 1 meeting was that Chairman Powell didn’t see any new rate INCREASES on the horizon. While there will certainly be opportunities to make money in a high interest rate stock market, investors would be well-served to evaluate their holdings and potentially make some changes.

The Federal Reserve started raising rates over two years ago in March of 2022 as it became clear that runaway inflation was not transitory as first thought, and the problem was not going to fix itself. By July of 2023 short-term interest rates had gone from close to 0% to over 5%, where they have essentially stayed since. Despite a slowing of inflation, it still stubbornly remains above the Fed’s 2% inflation target.

Currently, the market’s interest-rate cuts expectations have evaporated: Instead of the six quarter-point rate cuts expected earlier this year, the consensus now is that only one or two cuts will occur this year. Personally, I believe there’s at least a 50% chance we don't see any rate cuts from the Fed this year.

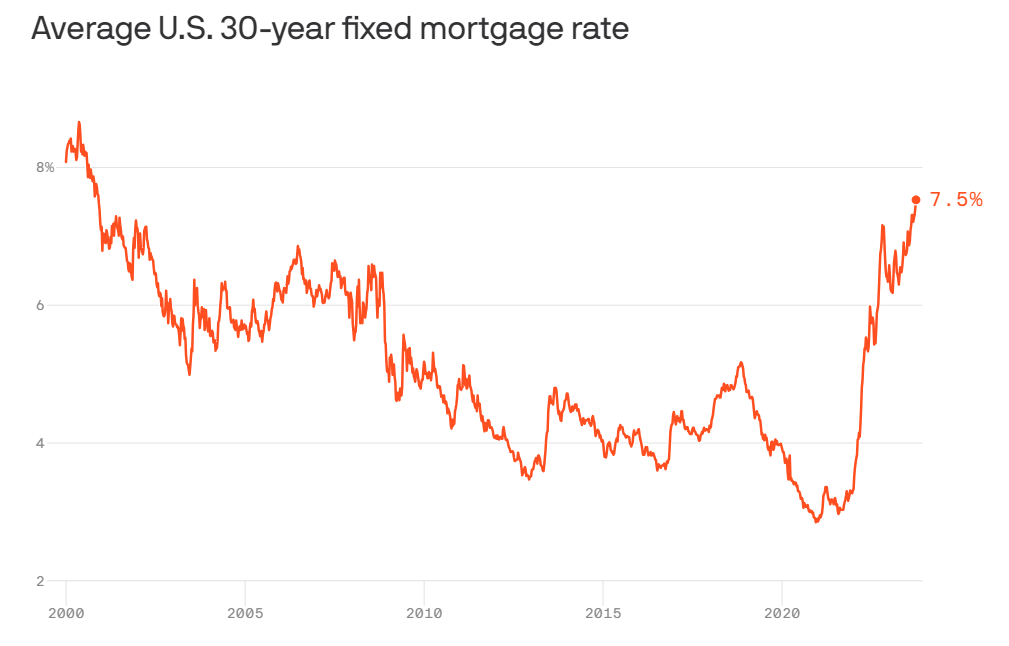

Operating under this assumption, here are a few things to watch for. First, the housing market will likely continue to be murky at best. The average interest rate on a 30-year mortgage is 7.5%, the highest level in two decades. That’s causing current homeowners to stay in their homes financed at lower rates rather than move into other homes with higher mortgage rates. This creates a domino effect as it limits available inventory for first-time home buyers that have essentially been priced out of the market. Reduced inventory, turnover, and new home starts are hitting companies that provide housing materials and build homes hard. When interest rates are high, that’s generally a sector of the market to avoid, and it’s part of why the economy in general could struggle in the next few months.

Another sector that is likely to be hit hard by a higher-for-longer environment is small-cap stocks. Smaller companies need to borrow capital to grow, and higher costs of capital push their profitability lower. Consequently, many are forced to put growth plans on hold. Additionally, elevated inflation usually hits consumer-discretionary industries. Americans could rein in their vacation travel, for instance, hurting companies in related businesses.

I also suggest exercising caution and selectivity with regards to corporate bonds in a high-rate environment. Many debt-laden companies, faced with higher rates, run a greater risk of default than I believe the market truly appreciates.

So, where can opportunities be found in a “higher for longer” interest rate environment? A good place to look is companies that have low levels of debt, have increasing sales, and that have the cash to purchase distressed companies. Some of the biggest and best-know technology companies have billions of dollars of cash available, and as small companies wrestle with high-interest debt, many have become targets rip for acquisition.

As always, choosing the right mix of investments depends on your goals, your timeline and your comfort level with risk. Don’t hesitate to get in touch with us if you’d like to discuss your investment portfolio.